Colin J Campbell re-examines Peak Oil.

"By 2050, the world will be able to support no more than about half its present population in their present style of life"

Oil and gas are finite resources formed in the geological past under now well-understood processes. That means that they are finite resources subject to depletion. The status of depletion is hard to assess both because public data on reserves are unreliable and because there is no standard classification of the several different categories, each having its own characteristics. Geologists are however trained to use logic and imagination to map rocks from one isolated outcrop to another and build an overall picture of their nature and distribution. They are therefore well placed to assess the situation.

For energy in earlier times, people relied mainly on their own muscles and those of their draught animals, and they used wood, charcoal and coal from outcropping seams for heat. Early man used flints for knives and arrow-heads before people turned to bronze, iron and steel for better tools and weapons. The pits from which these resources were extracted were progressively deepened into regular mines, but they were subject to flooding when they hit the water table.

Draining the mines led to a remarkable technological progression as the bucket and hand pump evolved into the steam pump which led to the steam engine that radically changed the world by facilitating transport and trade. That in turn led to the internal combustion engine around 1870, when a way was found to inject the fuel directly into the cylinder, making it much more efficient. At first, it relied on benzene distilled from coal before turning to petroleum refined from crude oil.

Oil from natural seepages had been known from biblical times but was first commercially exploited in the mid 19th Century as a source of paraffin (kerosene) to fuel lamps. Drilling, which was already in use for salt extraction, saw technological improvements, and was used to develop early oilfields, mainly in Pennsylvania, Romania and on the shores of the Caspian.

The internal combustion engine radically increased the demand for fuel and led to the rapid growth of the oil industry: the first automobiles took to the road around 1880 and the first tractor ploughed its furrow in 1907. This is not as long ago as it might seem, having been witnessed by the parents of an old man living today.

OIL AGE

The so-called Oil Age opened and led to radical changes for the world as the new energy supply stimulated industry and trade, allowing the population to grow six-fold in parallel. Every household is full of embedded energy, namely that used to make everything from the bedspread to the window pane. In earlier years, most people had lived in rural circumstance on whatever their particular region could support, but now increasingly moved to live in cities, depending on transport for food supply. Great achievements were made in many scientific and cultural fields, but it was not plain sailing as the world was engulfed in two world wars of unparalleled severity, in which oil supply, or lack thereof, played a critical role.

The oil industry itself grew rapidly with the formation of seven major companies, known as the Seven Sisters, who explored the world. The most prolific province in the Middle East, which is richly endowed with Cretaceous source-rocks, was confirmed when a well in the foothills of the Zagros Mountains of Iran blew out in 1908.

At first, exploration relied on geological field work with technology no more advanced than the hammer, hand lens and notebook, but then developed sophisticated geophysical methods to map the structures at depth, and geochemistry to understand the formation of the resources. When the onshore possibilities began to be depleted, the industry turned its attention offshore, moving into ever deeper waters which called for new technology to do so. Oceans cover much of the Planet’s surface but relatively few areas beneath them have the right geological conditions to yield oil and gas, with the Gulf of Mexico and the margins of the South Atlantic being prime tracts.

WILDCAT

A successful exploration well, or wildcat, was followed by appraisal wells to determine the size of the discovery more accurately in order to justify investments in the facilities, including pipelines. The size of a discovery is naturally subject to a degree of uncertainty. Estimated future production is termed Reserves, which are normally divided into Proven, Probable and Possible categories with the meanings the words imply, and probabilistic methods were also used. Production in a new field rose as wells were added to reach a plateau set by the facilities before natural depletion imposed a decline.

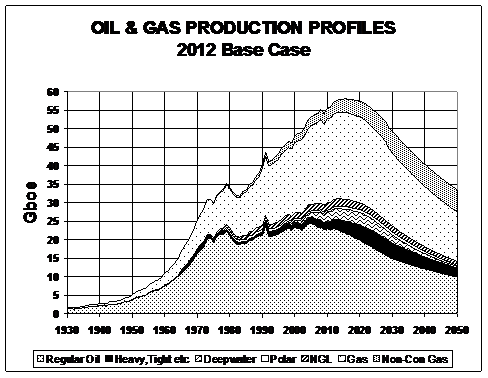

A country’s production profile reflected the timing and size distribution of its fields, but the overall peak of production tended to come close to the midpoint of depletion when half the available resource had been extracted. Today, more than fifty countries have passed their production peak, some being long into decline. The issue is however complicated by there being several different categories of oil and gas, as listed below, each having its own costs, characteristics and depletion profile. There is no standard classification, which is a cause of much confusion in the statistics.

-

Regular Conventional Oil and Gas: (A liquid, known as condensate, which naturally condenses from gas, may be treated together with Regular Conventional oil).

- Heavy Oils: with a density greater than 17.5o API, including bitumen (Degree API is an industry measure of density), but there is no standard cut-off for the definition of Heavy. Canada has 25o API, Venezuela has 22o API but 17.5o, which is relatively low, is here seen as a useful one so that all oil that can be produced in more or less normal ways may be included as Conventional.

- Oil Shale: oil that can be produced by heating immature source-rocks.

- Tight Oil and Gas (also called Shale Oil and Gas): as derived from rocks lacking adequate natural porosity and permeability that can yield production when artificially fractured.

- Deepwater Oil and Gas: in water depths greater than 500m.

- Polar Oil and Gas.

- Natural Gas Liquids from gas plants.

- Other Non-Conventional gases: coalbed methane, hydrates etc.

Public data on the size of reserves have become increasingly unreliable with reporting being subject to many political and commercial pressures. In 1960, the main producing countries formed the Organisation of Petroleum Exporting Countries (”OPEC”) to regulate production in order to support price, agreeing to base their shares of production on reserves. They came under pressure at a time of low prices in the mid-1980, which led to anomalous reporting : in 1984, Kuwait announced an increase in reserves from 60 Gb (billion barrels) to 90 Gb, although nothing particular had changed in its oilfields.

The numbers suggest that it may have changed to reporting the total found, termed Original Reserves, rather than its Remaining Reserves. In 1987, it announced a possibly genuine small increase to 92 Gb, but that proved too much for the other members. In the following year, Abu Dhabi matched Kuwait (up from 31 Gb), Iran went one better at 93 Gb (up from 49 Gb) and Iraq capped both at a rounded 100 Gb (up from 47 Gb). Venezuela for its part increased from 25 to 56 Gb but did so by including its non-conventional heavy oils that had not previously qualified for quota purposes. Saudi Arabia could not match Kuwait because it was already reporting more, but in 1990 announced a massive increase from 170 to 258 Gb. Since the OPEC countries currently supply almost 40% of the world’s needs, these anomalous reporting practices have a radical impact on global assessments.

CONVENTIONAL

Regular Conventional was the easiest and cheapest to extract. It dominated all past production and is likely to continue to do so for many years to come. The peak of discovery was in the 1960s and gave a corresponding peak of production in 2005. The growing shortages prompted a surge in price to almost $150 in 2008, compared with an average over the past century of no more than $25, quoted in terms of $2011 (as calculated in the BP Statistical Review). This in turn led to more costly and difficult Non-conventional sources, including that from so-called Tight Oil and Gas, obtained by artificially fracturing rocks lacking adequate natural porosity and permeability to provide a reservoir. The resource in the ground is enormous and unquantifiable, but the wells are costly, short-lived and subject to many environmental objections, so it is too early to assess the impact it may have on global production.

A debate rages as to the precise date of global peak production from all categories, but misses the point when what matters is the vision of the long decline that comes into sight on the other side of it. Despite the uncertainties, the following graph gives a reasonable approximation. The brief Middle East surge in 1992 reflects war-loss in Kuwait, which should be treated as production in the sense that it depleted reserves by like amount.

In short, it means that the Second Half of the Oil Age dawns. Logic suggests that it will be marked by a general economic contraction contrasting with the expansion of the First Half, which was driven mainly by cheap oil-based energy. Such a view conflicts with the underlying assumptions of economics which tends to assume that market forces must deliver eternal growth. Britain offers an instructive example. In earlier years, it worked cautiously, even having a national oil company, but then moved with the capitalist verve of the economist and the best of technology to produce as fast as possible.

Production surged to peak in 1999 at 2684 kb/d (thousand barrels a day) before falling to 881 kb/d in 2012. It exported at a time of low oil prices but now faces rising imports at high prices. With hindsight, a wiser policy might have been to deplete the resource more slowly so that it lasted longer. King Abdullah of Saudi Arabia has said that he wishes to leave as much wealth as possible in the ground for his grandsons, and Argentina has recently banned oil exports.

The transition threatens to be a time of great tension with riots and revolutions around the world as people blame their governments for consequential soaring food prices and rising unemployment, as indeed already witnessed especially in Africa and the Middle East.

COLLATERAL

The banks had been lending more than they had on deposit assuming that tomorrow’s economic growth was collateral for to-day’s debt. But growth requires increased energy supply that is no longer feasible in nature. By all means, nuclear energy as well as that from wind, tide, solar and geothermal sources can make a useful, and indeed essential, contribution, but are unlikely to match the easy oil-based energy of the past. The new reality has already imposed a financial collapse prompting what may come to be known as The Second Great Depression, which in fact may be more severe that the first that was prompted primarily by no more than excessive speculation.

But gradually as people come to appreciate that the underlying causes are imposed by nature they may adapt in more positive ways, and again come to live simple but happy lives on whatever their particular region can support. By 2050, the world will be able to support no more than about half its present population in their present style of life.

It is at root a geological issue, and geologists therefore have an important role to play to inform people and especially their governments of the underlying factors responsible for the radical changes that they must prepare to face.